schedule c tax form llc

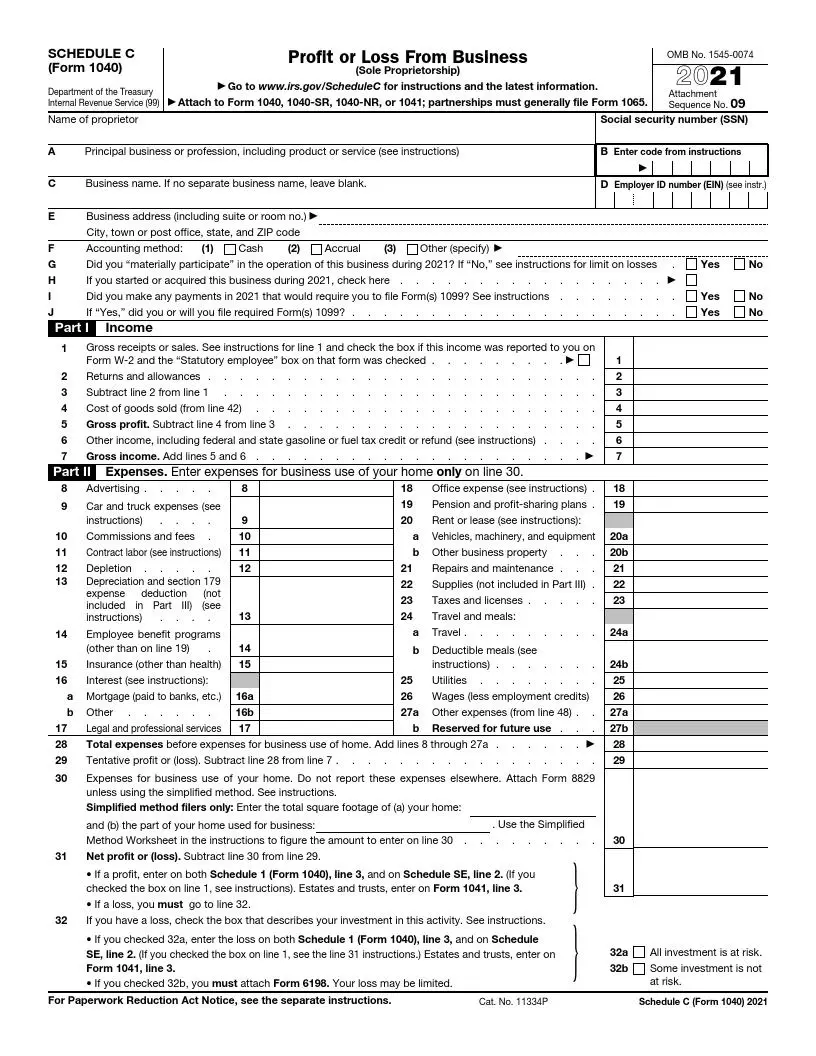

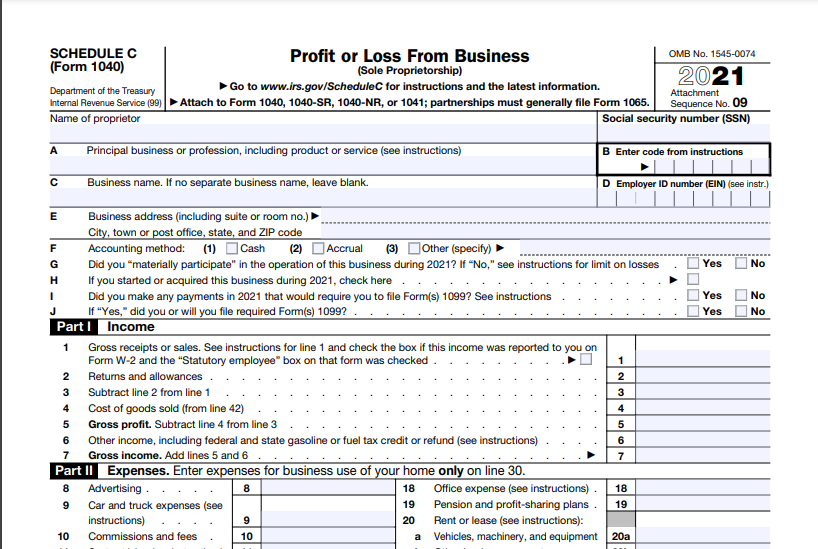

A Schedule C form is a tax document filed by independent workers in order to report their business earnings. A Limited Liability Company LLC is an entity created by state statute.

Self Employment Income How To File Schedule C

Its used to report profit or loss and to include this information in the owners.

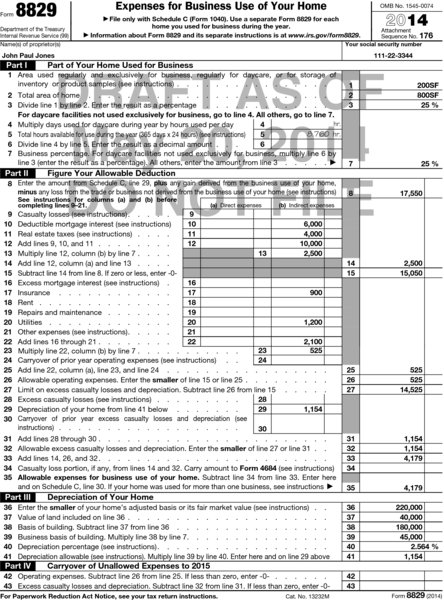

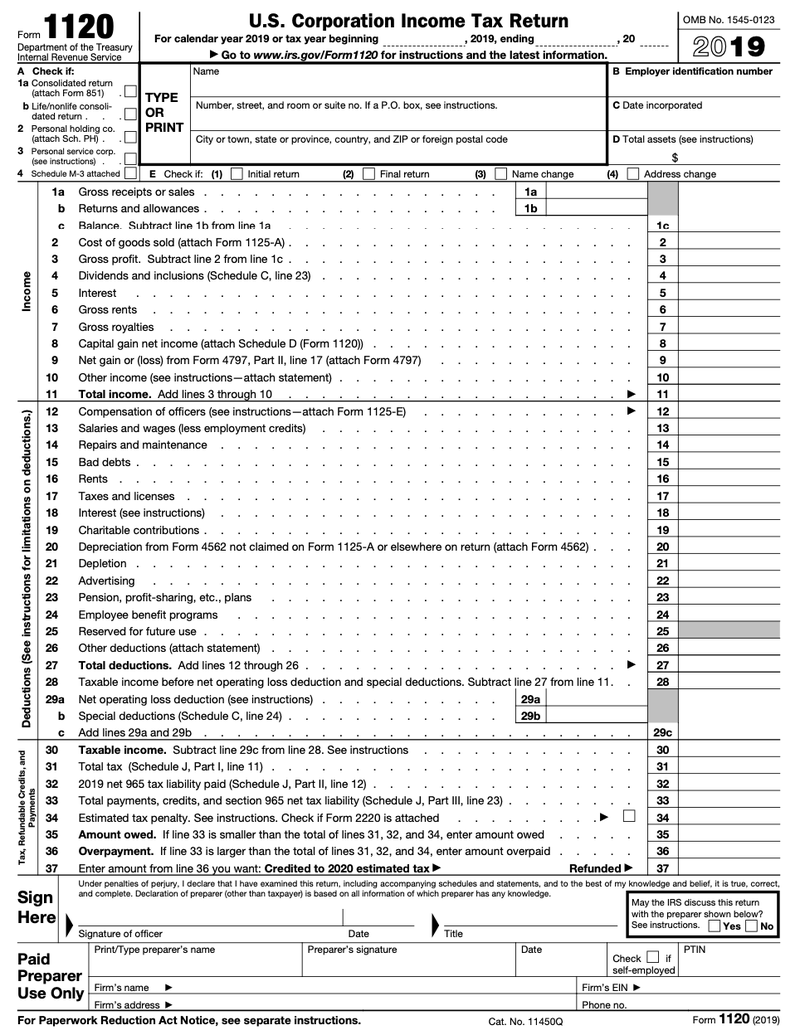

. If you still decide to have your LLC taxed as a C-Corp you will find the instructions listed below. Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. LLC ein on schedule c.

An LLC Schedule C should be used by a single-member LLC when filing business taxes as a sole proprietor. Ad Fillable SCHEDULE C Form 1040. The IRS forms for LLC filings vary.

Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation. Build Paperless Workflows with PDFLiner.

A Limited Liability Company LLC is an entity created by state statute. By contrast formally structured business entities such as corporations partnerships and some limited liability companies LLCs file separate tax returns. Single-member LLCs will file.

An activity qualifies as a business if. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Inst 1040 Schedule C Instructions for Schedule C Form 1040 or Form 1040-SR Profit or Loss From Business Sole Proprietorship 2021.

Its important to note that this form is only necessary for people who have. Form 8832 for C. Report Inappropriate Content.

Personalize Your Forms Download Instantly. Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes. Still want to elect C-Corp tax classification for your LLC.

Schedule C Form 1040 is a form attached to your personal tax return that you. If you run your own. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit.

Schedule C is an important tax form for sole proprietors and other self-employed business owners. Eliminate Errors Surprises. Small business owners who are filing business taxes as a sole proprietorship or single-member LLC must file using Schedule C Profit or Loss from Business.

Because you put your SS on the SS-4 form when you applied for the EIN the 2 are linked automatically. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and. Limited Liability Companies LLCs are required to file one of the following forms depending on how it has chosen to be taxed.

The profit is the amount of money you made after covering all. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a. Access IRS Tax Forms.

Complete Edit or Print Tax Forms Instantly. Printable SCHEDULE C Form 1040 blank sign forms online. Edit Fill Sign Share Documents.

Its part of the individual tax return IRS form 1040. Sole proprietors must also use a Schedule C when filing taxes. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Pdffiller Schedule C Form 2016 Pdf Tax Forms Irs Tax Forms Irs

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Filing A Schedule C For An Llc H R Block

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Tax Form Form 1040

What Is A Schedule C Tax Form H R Block

2021 Schedule C Form And Instructions Form 1040

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To File Tax Form 1120 For Your Small Business The Blueprint

Where Do I Deduct Website Expenses On Schedule C Taxes Arcticllama Com

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Forms Irs Taxes Irs Tax Forms

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

What Is An Irs Schedule C Form

Indie Authors Should Consider Using Schedule C Irs Tax Forms Tax Forms Irs

What Is Schedule C Form 1040 Uber Lyft And Taxi Drivers Gig Workers Friendly Tax Services Accountants And Tax Preparers